With current year GDP of 4.7%, 5.7% seems a bit ambitious target ! FBR is near its target of collecting Rs. 3106 Billion ,up 56% from 2013 figures. Real concerns are dip in Agriculture Growth (Cotton) & falling Exports !

**

Pakistan Plan Seeks Decade-High Growth as IMF Loan Nears End**

Faseeh MangiFaseehMangi

Kamran Haider

- Fiscal deficit estimated to decrease to 3.8 percent next year

- GDP seen rising 5.7% in FY17 from 4.7% in the current year

Pakistan is targeting the fastest growth in more than a decade, proposing cutting taxes to boost exports and support farmers in its spending plan as it wraps up a three-year, $6.6 billion International Monetary Fund loan program.

Pakistan proposed a zero-rated sales tax regime for exporters of textiles, leather, surgical instruments, sports goods and carpets, Finance Minister Ishaq Dar said Friday while presenting the government’s 4.89 trillion rupee ($46.7 billion) budget for the fiscal year starting July 1.

The fiscal deficit is estimated to decrease to 3.8 percent next year from an estimated 4.3 percent, he said. The spending plan will probably be approved by Parliament this month.

**“In three years we have achieved stability, now we will go for growth,” Dar said in Parliament in Islamabad. “We need to increase growth and job opportunities.”

**

Gross domestic product is forecast to expand 5.7 percent in the year starting July 1 on higher infrastructure spending, Prime Minister Nawaz Sharif said this week ahead of the budget presentation.

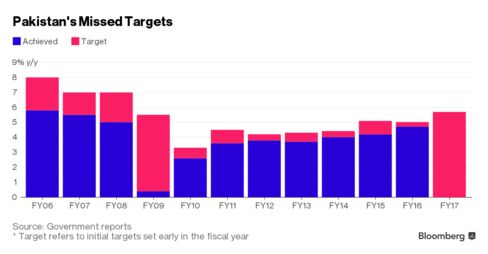

If Sharif is successful, it will be the first time in at least a decade that any Pakistani government has hit a growth target.

**Nonetheless, the economy’s accelerating expansion since he took office in 2013 has put Pakistan’s stocks and currency among Asia’s best performers during that time.

**

**For the coming year, Sharif aims to spend 1.68 trillion rupees to build roads, dams and ports, a 14 percent increase.

The nation is also looking to add power plants to end electricity shortages in two years, while also maintaining a fight against militants who have killed 60,000 people since 2001. Investments from China are also set to rise. **

The $45 billion China Pakistan Economic Corridor is getting under way and will contribute to growth, Sharif said last month.

“Chinese investment will start kicking in that will help end the energy crisis and there is a possibility of a rebound in agriculture,” said Yawar uz Zaman, head of research at Karachi-based Shajar Capital Pakistan Pvt.

Even so, the government may struggle to reach its target, he said.

The government will provide about 73 billion rupees in subsidies to decrease fertilizer prices and electricity tariffs for tube wells used in farming, Dar said.

Agriculture output, accounts for about a fifth of the economy, declined for the first time in 15 years. Sharif had already announced a 341 billion rupees agriculture relief package in September.

South Asia’s second largest economy also aims to raise about $1.8 billion selling global bonds including $756 million in sukuk in the next financial year.

'Looks Difficult’

As always in Pakistan, risks are ever present. Sharif’s efforts to privatize entities like Pakistan International Airlines Corp. have also met resistance. A recent tax amnesty to boost government revenues flopped, and an interest-rate cut by the State Bank of Pakistan last month as inflation quickened caught investors by surprise.

“There is a disconnect between the State Bank’s narrative and the cut,” said Sakib Sherani, chief executive officer at Islamabad-based research company Macroeconomic Insights Ltd., referring to looser monetary policy at a time when price pressures are seen rising. “There will be growth but a major breakthrough – as they wish to achieve near 6 percent – that looks difficult.”

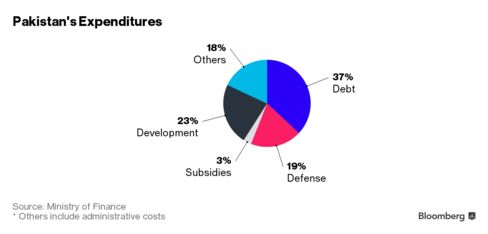

The military also eats up about a fifth of total spending. The defense budget has been increased 11 percent to 860 billion rupees and a separate 100 billion rupees is allocated for a military offensive against militants and to support people displaced by the operations, Dar said.

Even so, analysts see Sharif sticking broadly to the IMF targets as the program concludes. All end-March 2016 quantitative performance criteria, including the budget deficit target and the floor on the central bank’s net international reserves, have been met, the IMF said May 12.

“They will remain disciplined,” said Raza Jafri, director, research and development, at Intermarket Securities Ltd.“The IMF program will be ending but you are still getting a lot of money from Asian Development Bank and World Bank.”